Navigating the Fixed Rate Mortgage Cliff:

A Credit Connection Guide

With 12 interest rate hikes since last May and the cost-of-living ballooning, Australian households are grappling with a challenging financial landscape.

On top of this, a vast number of borrowers are about to see their fixed-rate loans expire, leading to a sudden and significant increase in their monthly repayments.

Why Fixed-Rate Mortgages Are Under the Lens

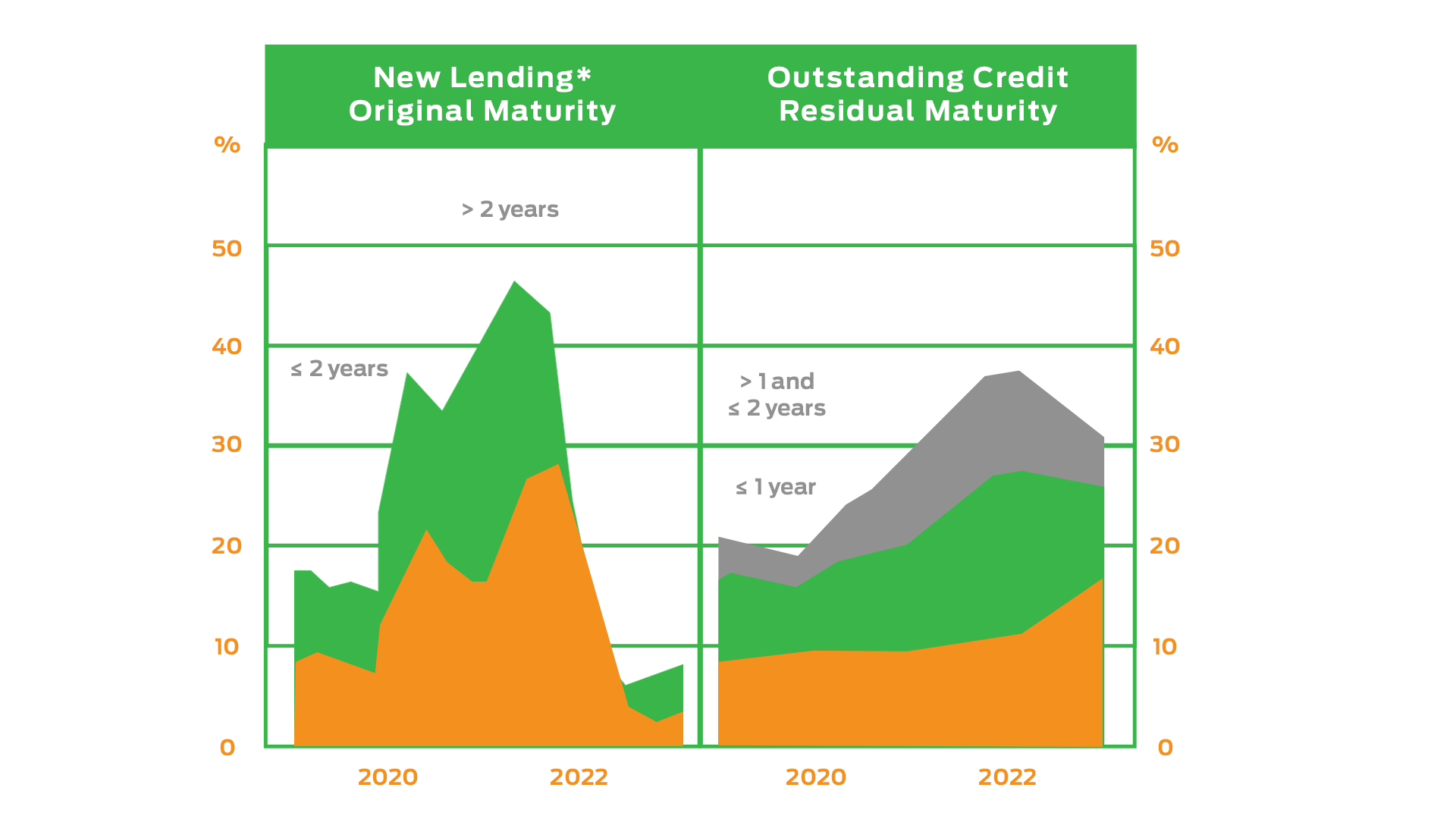

RBA data shows that the value of fixed-rate loans increased substantially during COVID-19, peaking at 40% of outstanding housing credit in early 2022.

That’s roughly twice their usual share from prior to 2020.

Some of these fixed-rate loans that expired in 2022 saw an increase of up to 50% in repayments! This trend will continue, and by the end of 2023, approximately 880,000 fixed-rate loans will expire.

With these pandemic-era fixed-rate home loans nearing their expiration dates, borrowers are at a crossroads.

Stay with their existing lenders at higher variable rates, or embark on the complex journey of refinancing, or look for a new lender altogether?

At Credit Connection, we have the expertise and data to guide you through this delicate time. In this article, we’ll explore strategies, potential pitfalls, and solutions for borrowers who are nearing the end of their fixed-rate terms.

The Cost of Complacency

If you think doing nothing is an option, think again.

When your fixed-rate term ends, your bank will likely tell you that you don’t have to do a thing. They’ll handle it all and shift you onto their standard variable rate. This transition will be presented as a hassle-free, almost charitable act.

But let’s be clear: This is far from a complimentary upgrade.

In reality, this automated switch is a revenue-generating machine for the bank. While you’re lulled into a false sense of security, thinking that everything is taken care of, your bank could be pocketing tens of thousands of extra dollars from you each year in interest payments.

That money could have been your holiday fund, your early retirement, or that dream vacation you’ve always wanted.

Why do banks do this? Because they can. And because the people who just let things roll are a significant source of profit.

You might as well be signing a check to your bank for tens of thousands of dollars—year after year.

🎯 Top 3 Actionable Tips

Question the Status Quo: If your bank says you don’t have to do anything, take it as a sign that you should probably do something.

Know Your Terms: Before your fixed rate term ends, mark it on your calendar and set reminders to start shopping for new rates at least three months in advance.

Run the Numbers: Use an online mortgage calculator to find out exactly how much more you’ll be paying if you let your mortgage roll over to a standard variable rate.

How Credit Connection Makes a Difference to Your Mortgage Rates

1. Unlocking ‘New Customer’ Rates for You: Banks usually reserve their best rates for new customers. As mortgage brokers, we leverage our extensive network to get you those elusive new customer rates, even if you’ve been with your bank for years.

2. Negotiating on Your Behalf: We don’t just stop at the first offer. We’ve sent back rate requests at the expiration of fixed periods multiple times to ensure that you’re getting the absolute best deal possible.

3. Analysing Variable Rates: While fixed rates have their benefits, variable rates can offer more flexibility and potentially lower costs over the long term. We’ll help you analyse whether this option suits your financial situation better.

4. Fresh Property Valuation: Lender rates can vary based on your property’s valuation. We facilitate new valuations to possibly lower your loan-to-value ratio, which can significantly impact your interest rate.

5. Custom Mortgage Action Plan: Every borrower is unique, and so are our financial strategies. We look at your complete financial picture to come up with a tailored plan that can save you thousands of dollars.

Preparing for the Inevitable: What Happens When Your Fixed-Rate Loan Rolls Over?

As we approach the peak of the mortgage cliff, preparation is your best defence against skyrocketing costs. Credit Connection is committed to helping you through this transition, ensuring you’re not just another casualty of the mortgage cliff.

Equity and LVR: Your Secret Weapons in the Mortgage Game

These two elements often sit quietly in the background of the mortgage landscape, overshadowed by more popular terms like “fixed rates” or “variable rates.” Yet, they wield enormous power in determining how much you pay for your home loan.

Especially in a fluctuating market, understanding your equity and LVR can be your ticket to potentially saving tens of thousands of dollars.

Equity is like a silent financial partner that grows stronger and more influential over time. It’s a resource you can leverage for various purposes, from negotiating better loan terms to even securing additional financing for investments or renovations.

A lower LVR is like a VIP pass in the mortgage world. It significantly reduces the lender’s risk, making them more willing to offer you attractive loan terms, including lower interest rates. This is especially crucial in a landscape where mortgage rates are shifting, and every percentage point counts.

How Equity and LVR Connect in Your Mortgage Strategy

Equity and LVR are intricately connected. As your equity increases, your LVR naturally decreases, assuming your property value remains constant or increases. By focusing on building equity, you’re also working to lower your LVR, hitting two birds with one stone and positioning yourself for better loan terms.

Credit Connection: Making Equity and LVR Work for You

In a credit landscape that’s continually evolving, your equity and LVR are dynamic assets that you can, and should, actively manage. They can be the key to unlocking more favourable loan conditions and giving you the upper hand in negotiations with lenders.

🎯 Top 3 Actionable Tips

Consolidate High-Interest Debt: Use your equity to consolidate other high-interest debts, effectively lowering your overall interest payments.

Quarterly Equity Check: Set a reminder to review your mortgage statements and local property values every quarter. Knowing your equity will prepare you for opportunistic refinancing.

Consult a Mortgage Broker: A mortgage broker can provide you with different loan scenarios that demonstrate how changes in your LVR could affect your loan terms.

As your fixed-rate loan term comes to a close, you’re essentially steering your financial ship towards a hidden iceberg. If you’re not prepared, the impact can be devastating.

🔥 Top 5 Tips For Navigating the Fixed-Rate Rollover

1. Fixed-Expiry Calendar Alert: Mark your fixed-rate loan expiry date like you would a medical appointment—it’s that crucial. Start looking at your options at least three months in advance.

2. The Variable Rate Money Pit: Switching to a standard variable rate without proper consideration is like throwing your money into a pit. Banks may earn tens of thousands from you—don’t let them.

3. Equity and LVR Leverage: Your home’s equity and Loan-to-Value Ratio aren’t just numbers; they’re negotiation tools. Use them wisely to get better terms, whether you stay with your current lender or find a new one.

4. Watch the Economic Indicators: Pay close attention to broader economic signals like the Reserve Bank’s interest rates and unemployment rates. These will give you clues about where mortgage rates are headed and help you make an informed decision.

5. Your Lifeline is a Call Away: At Credit Connection, we’re not just mortgage brokers; we’re your financial lifeline. A quick consultation can make the difference between years of financial strain and a future of financial comfort.

When it comes to rolling over from a fixed-rate loan to a variable one, ignorance is not bliss—it’s a one-way ticket to financial strain. Your proactive steps today can save you from future hardship.

At Credit Connection, we’re committed to ensuring that your financial ship not only avoids the iceberg but sails smoothly into prosperous waters.

For more insights on home loans and financial planning, check out our Blog Section.