According to the latest Australian Bureau of Statistics data released this month, the total value of mortgage refinance loans rose 20% year on year to over $17.1 billion.

10 years ago, that number was $4.99 billion.

We’re seeing more and more clients at Credit Connection who have been sold the idea that they should be refinancing their home loan every 7 years. I’ll show you why refinancing your mortgage isn’t always the best strategy and how it could end up costing you more in the long run.

What is refinancing?

Refinancing involves paying out your existing loan with a new loan. Refinancing requires a new home loan application and your new lender will examine your spending, income and employment history just like your old one did.

Beware of Banks bearing gifts!

Refinancing to a lower home loan rate might seem like a win-win situation, but it actually requires a serious amount of consideration. When you’re considering refinancing your home loan you need to work out whether it will actually improve your circumstances.

While it might sound nice that some banks are offering thousands in cash to refinance your home loan, is it too good to be true?

Unfortunately it’s no surprise that many of the enticements advertised by the banks are attached to uncompetitive products. A cash-back incentive is a juicy looking sugar hit to get borrowers over the line with a short-term feature on a loan that would ultimately cost them more in the long-term.

In short, a cash-back offer for a home loan refinance is a marketing incentive to attract new customers and have your mortgage debt on their books making them money for longer.

Have you thought about why you are refinancing?

Even when mortgage rates are rising, refinancing your mortgage may not be the right idea. The right idea depends on your personal goals, both long and short term.

Is your plan to put an extension on your property? Is your plan to buy and move in a few years’ time? Or is your plan to tap into your equity and buy an investment property? Those things might change what’s best for you.

Do you know your current home loan inside-out?

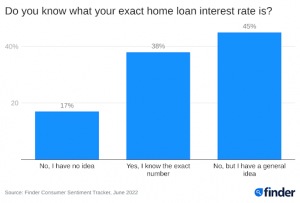

Worryingly, a recent Finder survey of homeowners revealed that 17% of mortgage holders “have no idea” what their home loan interest rate is. While a further 45% only have a general idea what interest rate they are paying. Only 38% of respondents knew what their exact home loan interest rate was.

Refinancing your home loan is not without its pitfalls

Banks don’t do anything that isn’t in their interest in the long-term. Refinancing your home loan without a thorough mortgage review by a professional, could leave you facing a number of unintended consequences.

Pitfall #1: Refinancing your home loan will reset the debt clock

Refinancing your mortgage will result in you resetting the clock on your mortgage debt and ending up at payment square one.

For example, if you have 15 years left on your current 30 year mortgage and refinance into a new 30-year loan, you will be making 15 extra years of loan payments.

Refinancing also resets the amortization schedule of your mortgage so you will be going back to paying a higher percentage of your payment as interest as well. Having a clear sense of how mortgage amortization works is important if you’re trying to pay off your mortgage.

Think of an amortization schedule as the bank’s way of pre-charging you the interest on your loan up front.

When you start paying off your mortgage in year 1, only 25% of your repayment will be going toward paying down the loan principal. 75% of your first year repayments go towards covering interest.

During the first 10 years of your mortgage more than half of your total repayments go towards covering the interest. That’s one of the reasons banks love customers who refinance their home loan regularly.

The bank always makes sure they get their money up front.

Pitfall #2: Underestimating refinance closing costs

Make sure you get a written estimate of closing costs from your bank instead of trying to guesstimate them on your own. Those costs commonly exceed $5000 and coming up short could halt your refinance deal or force you to put the balance on your credit card.

You’ll need to know all the details of your current mortgage, your credit score, and the market value of your home before you apply for a refinance loan.

Pitfall #3: Getting cash out with a refinance

Lenders who offer cash-out refinancing frame it as a bonus for you, as extra money you can use to pay down other bills, cover your closing costs, or take a vacation. But all it really does is put you deeper in debt with your house on the line.

Don’t base your financial strategy on “I’ll just Google it”

If you’re just searching on Google for answers to specific questions, how will you know you didn’t miss anything important?

What makes professional financial advice worth it is the ability of your advisor to keep you on track and proactively identify financial risks and opportunities for you before they arise.

I’ve often found that the greatest risks facing a new client weren’t even on their radar.

Our Mortgage Action Plan delivers guaranteed results and allows you to start living the life you deserve.