Top 5 Tips for Paying Down Your Mortgage Faster

Paying off your mortgage doesn’t have to be a decades-long slog. At Credit Connection, we believe in making this journey shorter and more manageable, so you can have less debt and more life!

Here’s a quick snapshot of the current financial climate:

• Average Mortgage: $624,000

• Average Credit Card Balance: $3,043 per account, with 22.7 monthly transactions.

• Average Household Debt: $187 for every $100 of after-tax income.

• Average Rental Cost: $620 per week for houses & $590 for units.

For most Aussie homeowners, achieving mortgage-free status is the gateway to financial freedom and peace of mind. Imagine what life could be like without that monthly deduction from your account – more savings for that long-awaited holiday to the Whitsundays, additional funds to invest in your children’s future, or perhaps, the simple joy of knowing your home is entirely yours.

Whether you’re in a quaint Queenslander in Paddington or a modern apartment in Sydney, the principles of smart mortgage management remain the same. Let’s dive into the strategies that can help you pay off your mortgage faster and smarter.

Understanding Your Mortgage

Understanding your mortgage goes beyond the basics of principal, interest, and term. It involves grasping the real nitty-gritty bits that can significantly impact your financial trajectory.

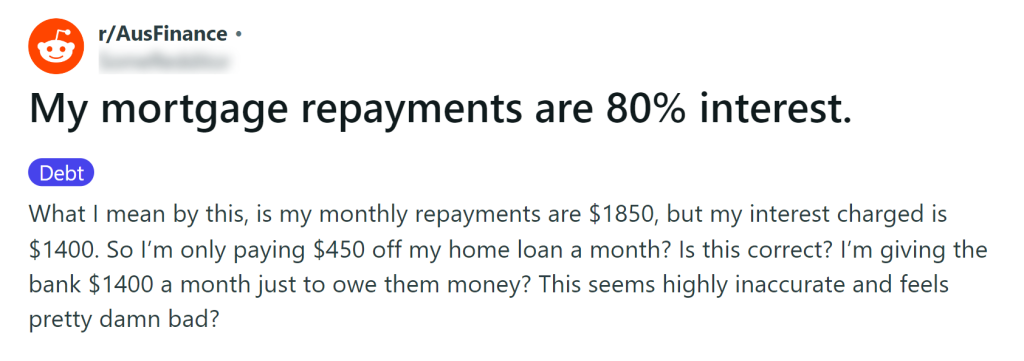

Amortization: Its Role in Your Mortgage

Loan amortization is a powerful tool in the banking industry, allowing banks to manage risk, predict cash flow, and maximise their profits. However, it also places a significant responsibility on borrowers to understand how their payments are structured. By comprehending the mechanics of amortization, borrowers can make informed decisions about their loans, potentially saving a significant amount in interest over the long term.

Loan amortization involves structuring payments so that they cover both the principal (the amount borrowed) and the interest (the cost of borrowing). This system offers a clear schedule by which the loan is gradually paid off.

✅ Front-loaded Interest: In the early stages of a loan’s amortization schedule, a larger portion of each payment is allocated to interest rather than the principal. This means banks collect most of the interest due on the loan in the first few years.

✅ Profit Maximisation: By collecting interest upfront, banks maximise their profits early in the loan term, reducing their risk if the loan is paid off early or refinanced.

Knowing that each payment brings you closer to owning your home outright can be a strong motivator. On the other hand, realising how much of your early payments go towards interest can be eye-opening and may inspire more aggressive repayment strategies.

Borrower Implications of Mortgage Amortization

✅ Understanding Total Cost: Borrowers may not initially realise that they are paying more interest upfront, which affects their total cost of borrowing.

✅ Refinancing Decisions: Understanding amortization can influence a borrower’s decision to refinance, especially when most of the interest has already been paid.

5 Expert Tips for Paying off Your Mortgage Faster

Here are five expert tips, packed with actionable advice and resources from Credit Connection, to help you accelerate your mortgage repayment.

1. Use apps reviewed on Choice to compare fuel prices in real-time and find the cheapest options near you. A consistent effort to fill up at the right place and right time could save you $500 annually.

2. Use refillable items. Products such as handwash, dishwashing liquid, household cleaning products and even high-end perfumes have refillable products.

3. Use sites like OzBargain for deals and discounts on a range of products from groceries to gadgets.

4. Make online grocery shopping the norm. Did you know that Aussies spend more than $13 billion yearly on impulse purchases? Shopping from your screen helps you stick to your list, and dodge impulse buys.

5. An offset account is a powerful tool for reducing the amount of interest you pay over the life of your loan. By keeping your savings in an offset account, you lower the principal amount on which interest is calculated.

By implementing these strategies, you’re not just paying off a loan; you’re building a foundation for financial freedom and long-term security.

Remember, every small step today is a stride towards a mortgage-free tomorrow.